Trade Receivables Debit or Credit

Please ask about details on fees and terms and conditions of these products. Deposit and loan products are offered by Associated Bank NA.

Is Trade Receivables Debit Or Credit Unbrick Id

Entering a credit memo.

. The accounts receivable classification is also comprised of non-trade receivables which is a catchall for any other type of receivable. Trade receivables are only those receivables generated through the ordinary course of business such as amounts that customers owe in exchange for goods shipped to them. Eazypay is a one-stop solution for all merchants to collect payments from their customers.

Credit card sales recorded in Invoicing always are posted to the Accounts Receivables posting account you set up for the customer in Receivables Management. Contextual Banking Experience CBX from iGTB is a white label digital transaction banking platform to manage firms cash and trade that leverages Machine Learning and predictive analytics delivered through APIs and an omnichannel UX. These cards are used primarily for rewarding and motivating employees and help make saying thank you simple and satisfying.

A debit note also known as a debit memo is a document sent by the seller to the buyer informing about the current debt obligations or it may be a document sent by the buyer to the seller at the time of returning goods as proof return outwards. Relevant insurance coverage if applicable will be required on. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable ie invoices to a third party called a factor at a discount.

Relevant insurance coverage if applicable will. Depending on the purpose of the debit note it can provide information regarding a forthcoming invoice or serve. We offer a full range of solutions that include the collection of consumer payments via the telephone Internet or check-to-ACH conversion as well as payments to employees and vendors.

In addition you can post trade discounts terms discounts taken and freight and miscellaneous charges only. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their. This is a guide to the top difference between Debit Note vs Credit Note.

Test your understanding 3. Use the Receivables Transaction Entry window to record a decrease in a customers account balance such as a one-time incentive or a deduction on a freight charge for goods that didnt arrive when scheduled. You can apply a credit memo to sales invoice debit memo finance charge and servicerepair transactions.

Calculate the allowance for receivables and the irrecoverable debt expense as well as the closing balance of receivables for each of the years 20X1 20X2 20X3. Debit note impacts account receivables and cause the same to lower down whereas a credit note impacts account payables and causes the same to lower down. Call Us 24x7 Customer Contact Center 1860 266 2666 Local charges applied 91 22 6600 6022 Overseas charges applied.

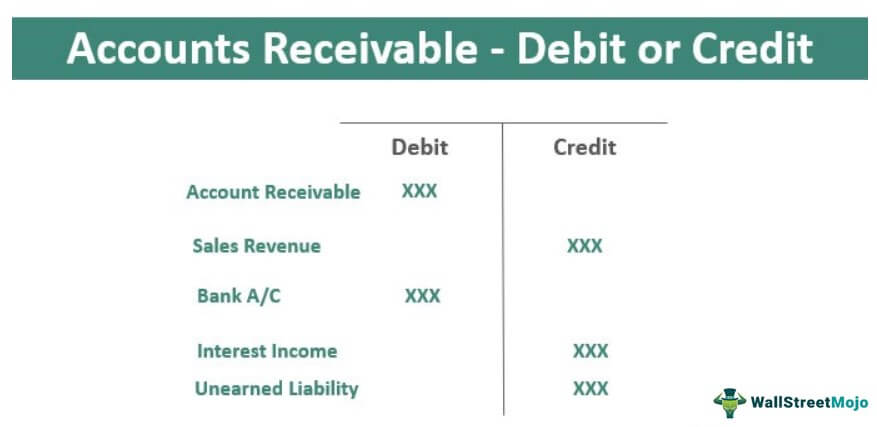

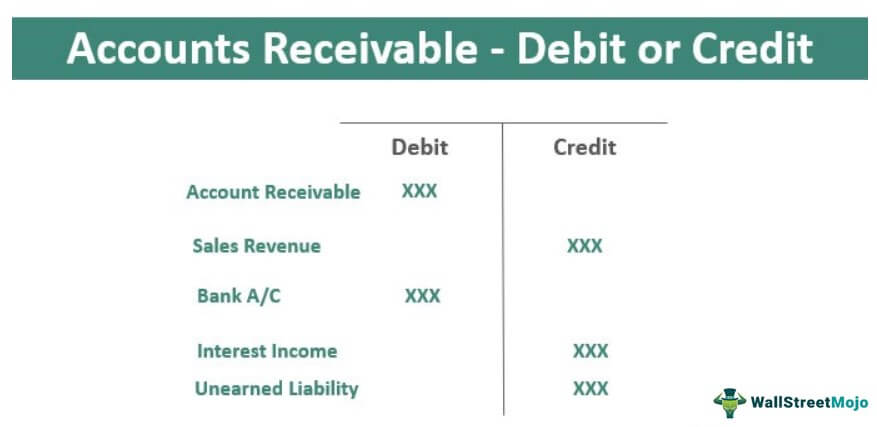

Accounts ReceivableKeiths Furniture Inc. Finally to record the cash payment youd debit your cash account by 500 and credit accounts receivableKeiths Furniture Inc by 500 again to close it out once and for all. It is a mobile based application which allows you to quickly raise an invoice and your customers can pay you immediately through any convenient payment mode Unified Payment Interface UPI Credit Card Debit Card Internet Banking or Pockets wallet.

For example amounts owed to the company by its. To record a trade receivable the accounting software creates a debit to the accounts receivable account and a credit to the sales account when you complete an invoice. These non-reloadable prepaid cards are available to purchase in bulk and can be used at millions of merchants nationwide who accept Visa debit cards.

Loan products are subject to credit approval and involve interest and other costs. ACH can streamline your. Eazypay - mobile application.

The HSA Plus debit card from Associated Bank can be used to pay for eligible products and services not covered by your health insurance. You can enter credit. Loan products are subject to credit approval and involve interest and other costs.

You can post other distribution amounts only to Receivables Management accounts. AD Category I banks may deliver one negotiable copy of the Bill of Lading to the Master of the carrying vessel or trade representative for exports to certain landlocked countries if the shipment is covered by an irrevocable letter of credit and the documents conform strictly to the terms of the Letter of Credit which inter alia provides for such delivery. When the customer eventually pays the invoice the accounting software records the cash receipt transaction with a debit to the cash account.

A business will sometimes factor its receivable assets to meet its present and immediate cash needs. CBX provides the 400 user journeys that span the full complexity. Here we also discuss the Debit Note vs Credit Note key differences with infographics and.

When a client doesnt pay and we cant collect their receivables we call that a bad debt. John Stamp has opening balances at 1 January 20X6 on his trade receivables account and allowance for receivables account of 68000 and 3400. Citi has been providing high-quality Automated Clearing House ACH Payment and Receivables Solutions to our clients for over two decades.

Please ask about details on fees and terms and conditions of these products. Accounting for Trade Receivables.

Accounts Receivable Debit Or Credit Top Examples Treatment In Ifrs

Trade Receivables And Revenue Acca Global

Comments

Post a Comment